Extreme storms, flooding contribute to jumps

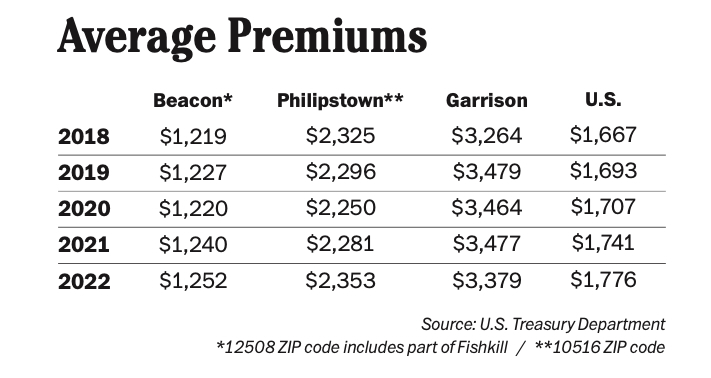

Homeowner insurance costs rose in Beacon and most of Philipstown between 2018 and 2022, according to a federal study of extreme weather’s effect on premiums, claims and cancellation rates. Garrison was an exception, with a slight drop in rates.

The Federal Insurance Office at the U.S. Treasury Department describes its report, released Jan. 16, as “the most comprehensive and granular snapshot” of the homeowner insurance market. The data, organized by ZIP code, is based on 49 million annual policies collected in partnership with state regulators and the National Association of Insurance Commissioners.

The average premium rose 8.7 percent faster than inflation between 2018 and 2022, according to the report, with homeowners in the ZIP codes with the highest expected annual losses from climate events paying 82 percent more on average than those in the lowest-risk areas.

Although flooding is a risk and home prices are above the national average in the Highlands, it did not have the scale of increases seen in coastal communities such as Palm Beach ($40,719 average premium in 2022) and Miami Beach ($34,055), where homeowners are at high risk from the impacts of sea-level rise and extreme storms and pay the highest rates in the country.

The average annual premium in the Garrison ZIP code (10524), while higher than the national mean, fell $100 in 2022 after peaking at $3,479 in 2019. Homeowners in Beacon (12508) paid a five-year high ($1,252) in 2022, as did Philipstown homeowners in the 10516 ZIP code ($2,353).

In a separate analysis using 2023 data from researchers at the National Bureau of Economic Research, The New York Times found that average premiums rose by 20 percent in Dutchess County ($1,645) compared to three years earlier and by 41 percent in Putnam County ($2,436) during the same period. (Manhattan premiums averaged $7,941 in 2023, an increase of 87.3 percent from 2020.)

The Federal Insurance Office found that nonrenewal and cancellation rates for policies were higher in areas with the greatest risks of losses from extreme weather. Insurers can cancel policies for nonpayment of premiums or for other reasons, such as misrepresenting a home’s condition. They can also decline to renew policies based on climate risks or other factors, such as roof age.

In addition, customers can choose not to renew policies if rates jump, a decision more homeowners made in 2022, according to FIO. Nationally, according to the Insurance Information Institute, about 12 percent of homeowners don’t have insurance, up from 5 percent in 2019. Mortgage lenders typically require it, whatever the cost, but about 40 percent of Americans own their homes outright.

In the 10516 Philipstown ZIP code, the percentage of policies that insurers declined to renew, or that they canceled for nonpayment or reasons other than nonpayment, reached a five-year high in 2022.

The percentage of policies canceled for nonpayment in Garrison fell but cancellations for other reasons reached a high. In Beacon, the percentage of policies that insurers canceled for nonpayment rose in 2021 and 2022 but remained below 2018 levels, and coverage canceled for other reasons fell to a five-year low.

Insurance companies are having to cover increasing amounts of damage from extreme weather. In 2024, the U.S. experienced 27 climate and weather events with at least $1 billion in damage, after setting a record with 28 in 2023, according to the National Oceanic and Atmospheric Administration (NOAA). Last year’s losses totaled $183 billion, $67 billion more than NOAA’s estimate for 2023.

Hurricanes and the flooding and tree damage they produce are the biggest risk in the Northeast, according to the report. Hurricane Ida, whose rains spurred extensive flooding at The Lofts in Beacon when it reached the area as a tropical depression in September 2021, caused the most damage in the region during the study period, said the U.S. Treasury.

In addition to 17 deaths, the damage in New York from Ida amounted to $7.5 billion and flooding affected 11,000 homes, according to the state.

Two years later, an intense storm dropped more than 6 inches of rain in Cold Spring and more than 8 inches in Highland Falls on July 9, 2023, causing severe flooding in Philipstown and at West Point that swept away cars and bridges and shut down roads and Metro-North’s Hudson Line.

A report by the Dutchess County Transportation Council on infrastructure at risk from extreme weather concluded that the eastern edge of Main Street in Beacon, past the intersection of Verplanck Avenue, is particularly at risk because it runs alongside Fishkill Creek before the water reaches the falls and drops to below street level.

Neighboring Ackerman Street, Herbert Street and Blackburn Avenue are also considered high-risk for flooding, and the report found that many neighborhoods near Mount Beacon and the Fishkill Ridge have a “very high” susceptibility to landslides, one of the products of heavy rainfall.