Cold Spring faces challenges from storms, tourism

The Current this week asked Cold Spring Mayor Kathleen Foley to comment on issues the Village Board faced in drafting a fiscal plan for 2024-25.

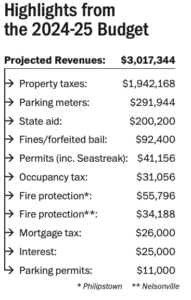

The tentative budget includes a 3.9 percent increase in the property tax levy and $3,017,344 in spending from the general fund, which covers most services, such as police, garbage collection and street maintenance, along with administration, parks, legal fees and wages. A public hearing is scheduled for 7 p.m. on Wednesday (April 10).

Foley’s responses, which she provided by email, have been lightly edited for space.

What were the biggest challenges for the board when drafting the budget?

Repeated, expensive storm responses; extensive engineering needs and urgent infrastructure projects; a limited ability to increase staff despite ever-increasing workloads; and constantly rising costs for materials and services, such as those related to tourism.

These challenges are compounded by having few revenue streams. Putnam County is determined not to share sales tax. It markets Cold Spring as a destination but makes almost no contribution to tourism costs. As a result, the trustees must reduce the burden on village taxpayers by collecting revenue from visitors in other ways, such as parking meters, Seastreak docking fees and the occupancy tax [on hotel rooms and short-term rentals].

The revenue from metered parking and Seastreak appears to be less than anticipated in 2023-24. How did you approach estimating revenue for 2024-25?

Actually, we estimated $28,000 in revenue from Seastreak and billed [but have not yet received] $37,488, despite Seastreak’s curtailed schedule and poor weather in the fall. And instituting a cancellation fee last year gave us insulation in that budget line.

The lower revenue for parking was a result of the board’s underestimation of the timeline to implement the plan. The local enabling legislation modifications had to pass a public process, and the practical elements had to move forward in tandem, such as installing signs and meters, issuing resident permits, onboarding payment and ticketing technology and training staff in multiple departments.

As we finalize the 2024-25 budget, resident permits are in place and meters are becoming operational; Seastreak negotiations are in process. We expect to hit our revenue targets more closely this fiscal year.

Aging infrastructure is an ongoing issue. What are the priorities for 2024-25, and how will they be funded?

Aging infrastructure is an ongoing issue. What are the priorities for 2024-25, and how will they be funded?

Our administration is clear-eyed about what must be done to protect life, safety, residential neighborhoods and our local economy: Face climate collapse head-on, engineer properly and build for resiliency.

The failed culverts on Fair Street are the immediate priority — they are linchpins for other system upgrades. The Fair Street work, estimated at $1.5 million, will likely begin in late fall; it is under review by the Federal Highway Administration for a grant from its Emergency Relief Fund. If approved, FHWA would fund 80 percent. Fund balance will be used for some of our 20 percent share, and we will likely need to borrow.

The overarching infrastructure spending priority for this budget is project engineering and, in particular, a hydrologic and hydraulic study. These studies create roadmaps for solving problems across a watershed’s catchment area, holistically. Cold Spring has never undertaken this fundamental study.

Continued dam repair engineering is in the budget, as well. We are pursuing grants for the planning and construction phases of all major infrastructure work.

Continued dam repair engineering is in the budget, as well. We are pursuing grants for the planning and construction phases of all major infrastructure work.

Occupancy tax revenue is included in the budget, but none is projected for short-term rental permit fees. Do you anticipate no revenue from STRs?

We have drafted the required local legislation to enable occupancy-tax collection and will bring it to a public hearing and adoption early in the fiscal year. We will begin with collection from hotels and bed-and-breakfasts — the most easily collected portion. Revisions to the short-term rental law are needed before a public hearing and adoption and enforcement of permits and implementation of the tax. Other legislative needs took priority in 2023-24. We hope to realize revenues from STR permits and taxes during this budget year, but we want to be realistic about timelines and conservative in income estimates.

In the three most recent budgets, the tax levy was less than the maximum allowed by the state. The 2024-25 budget relies on the maximum 3.9 percent. What changed?

Although we are levying the full 3.9 percent, the budget [increase] is still within the cap of 2 percent — we are meeting our mandate to limit annual increases. We are levying the full amount because the mortgage tax income, which saw a bump during COVID, has fallen back to pre-pandemic amounts. Also, the development of the Butterfield site added growth to the tax base for several budget cycles; that bump is tailing off. At the same time, we must meet burgeoning operating expenses for services and the increased urgency of infrastructure repairs. In short, the village must use the full levy to offset expenses and balance the budget while staying within the 2 percent cap.

The complete budget is available at bit.ly/cs-budget-2024.

I wanted to take the time to thank the Village Board for its hard work developing the FY 2024-25 budget. As I observed a number of the board’s planning sessions, there was no doubt that the village’s best interests were top of mind when making some difficult but necessary decisions. During last evening’s budget hearing and following the board meeting, the mayor noted that change is difficult and takes time. It reminded me of the Heraclitus quote: “There is nothing permanent except change.” The example of the change in refuse procedures was an excellent illustration and, for most, is now a past issue. Hopefully, the recent Main Street and residential parking changes will be more fully accepted and the village will continue to look forward. The 44th president, Barack Obama, famously said: “Everybody must pay their fair share.” This theme was echoed by the current president during his election campaign in 2020. The 2024-25 village budget reflects this need for all to pay their fair share. Visitors will need to pay their share of the burden to visit Cold Spring. Residents will see a general fund tax increase and increases in water and sewer rates. Unfortunately, these increases are inevitable, especially in an economy with sustained high inflation rates and a village with necessary infrastructure improvements. FY 24-25 gives the Village Board a unique opportunity for Cold Spring to be a leader in “fac(ing) climate collapse head on” as part of its larger strategy of protecting life, safety, residential neighborhoods… Read more »