But is it smarter to ask for the maximum hike?

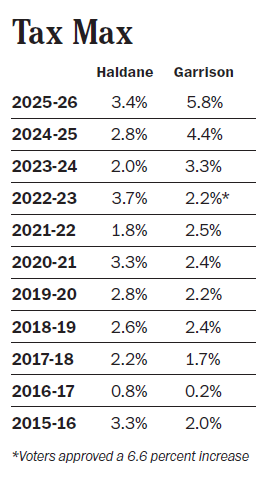

While the Haldane school board debated on Tuesday (March 4) whether to take advantage of the full property-tax increase allowed by the state for 2025-26, the Garrison district said on Wednesday it would ask for 2.2 percent less.

In either case, voters will decide on May 20 whether to approve the budgets, which as of this week were $30.2 million at Haldane and $14.5 million at Garrison.

At Haldane, the budget proposed by interim Superintendent Carl Albano would translate to a 2.8 percent tax increase, the same approved last year. But the district’s maximum allowable for 2025-26 under a complicated state tax-cap formula is 3.38 percent. If the district asked voters for the maximum, it would mean another $132,000 for the bottom line.

Albano said that he believes Haldane can go with the lower increase, especially after voters last year approved an increase of 6.95 percent over three years to pay for a $28.4 million capital project. “We are mindful that the community supported a pretty significant tax increase,” he said. “Therefore, we are doing our best to be efficient with the operating budget.”

In response, Trustee Ezra Clementson wondered if failing to take advantage of the full cap was shortsighted. “I want to make sure that what we’re doing is not unduly causing a problem down the road,” he said.

Clementson noted that failing to budget $132,000 for 2025-26 translates to a reduction of more than $600,000 over five years, a financial decision that the board could come to regret, especially with higher inflation.

“When you’re short, you have to pierce the cap, which is not easy to do,” said Clementson. Under state law, a district can raise taxes over the cap only if 60 percent of voters approve, rather than a simple majority.

“Our No. 1 role is to provide opportunities for children,” said Clementson. “By making budgets that go to the cap, you’re doing the most financially sound thing you can possibly do with regular majority votes.”

Maggie Valentine, the vice president, said she was concerned about raising taxes on top of the capital spending. “There are so many people on fixed incomes,” she said. “Not everybody has a dual income. There are people really stressed out about” the tax hike.

Like Clementson, Sean McNall and Michelle Kupper wondered about the long-term impact of not raising taxes to the max. Peggy Clements, the president, noted the district has not, during her 10-year tenure, ever proposed a budget under the cap, which New York State enacted in 2012.

Following the discussion, Albano said he would bring a more detailed spending plan with the maximum cap to the March 18 meeting. He said “there’s a long list of things that we could do” with another $132,000, such as replacing fluorescent lights in classrooms with more-efficient LEDs.

The draft budget presented on Tuesday includes funding for a science-of-reading curriculum ($50,000); software to improve student outcomes ($10,000); a new pre-K program ($100,000); special education funding for out-of-district placements ($200,000); increased field trip spending ($20,000); a softball field dugout ($20,000); classroom air conditioners to comply with new state maximum temperature requirement ($30,000); auditorium stage and performing arts equipment ($30,000); and a transportation system analysis ($20,000).

The Haldane budget anticipates that the district will receive $4.4 million in expense-based state aid, a reduction of $161,000 from 2024-25, and an additional $58,000 in Foundation Aid.

Garrison district

At the Garrison school board meeting on Wednesday, Superintendent Greg Stowell proposed a budget that includes a 3.58 percent tax increase, or 2.2 percent less than the 5.78 percent cap set by the state for the district for 2025-26. Last year, Garrison raised taxes by 4.44 percent, the maximum.

The proposed 3.58 percent increase “is reflective of what we need, is respectful to the taxpayer and continues to promote the high-quality education that our community has come to expect,” said Stowell. “We’re very happy with what we put in this budget to really move the district forward.”

Joseph Jimick, the district business manager, said Garrison is able to keep its projected tax increase well below the cap by relying on $1.3 million of its $2.7 million in savings, or “unappropriated fund balance.”

Jimick said the district’s auditor recommended Garrison reduce its savings, which state law says must not exceed 4 percent of the budget. Jimick said the fund balance had risen because of increased state aid and grants and lower special-education costs.

The largest new expense would be $650,000 to repair the roof and fix sidewalks, outdoor staircases and retaining walls. Jimick said that, because those projects are considered capital expenditures, they allow for a higher tax cap under the state formula.

The district is also considering allocating funds to hire an armed police officer and launch a lunch program. The Garrison Teachers’ Association has urged the district to add the armed officer.

Other expenses that will increase in 2025-26 under the draft budget include a summer scholars program that is no longer funded by grants ($30,000); tuition paid to Haldane, O’Neill and Putnam Valley for the district’s high school students ($67,520); transportation ($112,211); tuition for special-education students who attend other schools ($155,000); new science textbooks ($41,000); legal expenses ($63,000); employee health insurance ($149,441); energy-saving improvements ($93,212); design work for Garrison Forest improvements ($10,000); consultants to improve environmental education ($15,000); copier lease-purchase agreements ($15,000); the annual Youth Climate Summit ($10,000); field trips ($25,000); and professional development for teachers ($30,000).

As someone who has sat in the Haldane school board chair for many years, I think it’s important to remember the school tax isn’t the only tax the general public has to deal with. I was always reminded that while the Haldane tax was going up, there are also increases in town, village, county, state and federal taxes. When you compound that, the reality changes a bit.

Haldane has a solid fund balance. With the recent capital increases, I’d advise being prudent and don’t go for the maximum state cap. Given our low state-aid ratio, the taxpayer funds most of the school’s budget. Please keep the big picture in mind.